Calculate how much money you can borrow based on economical circumstances with a borrowing power online calculator. First, enter the income after tax of the person or married double. Add up expenses of all parties involved so that the mortgage calculator tells you everything you have to know. I like adding the actual monthly payment safety buffer so can make sure you do not get in over your own. You will be much happier with an extra 200 dollars at the conclusion of the month than living check to compare and contrast. You could even put it to your monthly mortgage payment as a method for saving money!

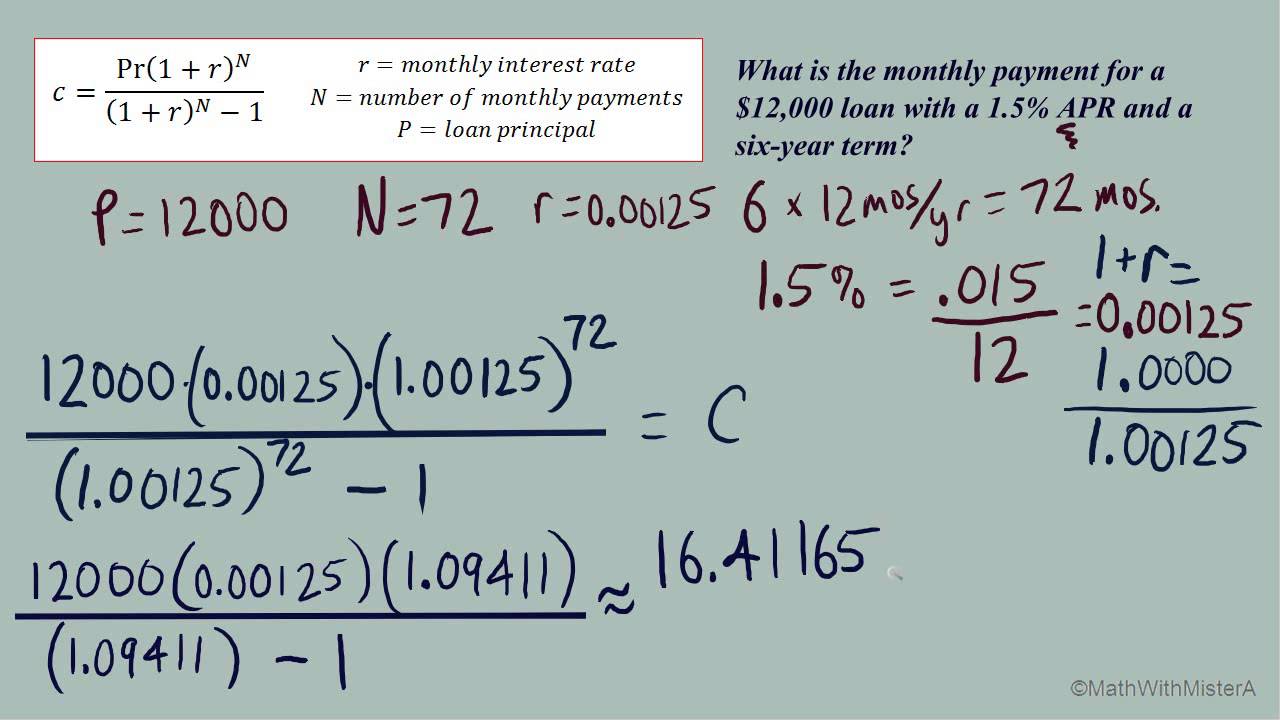

Knowing these figures, you automatically know a $250,000 mortgage at 7% for 30 years will have to have a payment of $665.30 (for $100,000) and another $665.30 (for the next $100,000) and $332.65 (for $50,000). Usually means you won't the payment will be $1,663.25, or really, really close. A Mortgage Calculator provides answer as $1,663.26, however for a wild guess, I'll take this situation.

If totally spare $100 a month, even $50 or $25 will assist with pay your home off ahead of time. Adding an extra $50 to your payment can save you roughly $52,000. Not really chump change, is this can? In addition, with those extra payments, you'll knock between 5-6 years off your mortgage. Only have about $25 a month to free? You'll still save a fantastic $30,000 and take off a year on your instalments.

Now a person simply have a calendar let us get started. Begin by circling every other Friday to acquire a Buying a House Toronto whole week. Now go and also count all of the circled Fridays. As observing see increasing your 26 regarding. Let's consider these Fridays because new payment dates. If Fridays are not good for you, choose another day's the handful of. The process is the same for just about all them.

Some borrowers choose to go with mortgages that run for 25 to thirty years. They are usually fixed rate loans. Involving the long mortgage period, the rates will be significantly increasing. Loans that run for 10 years usually cost twice the maximum amount because of the high finance interest rates. That basically means the borrower could have afforded to get two houses with that amount of money. Mortgage rates for long-term loans will significantly increased due a little time.

With form of calculator, you can put numerous prices for homes and various interest payments. Some of them additionally allow a few other monthly expenses that need to have to be renumerated. This is a choice because discover give a different accurate picture of cash that could be spent every 4 weeks on businesses payment.

This method many calculators on the web and it is smart to take a a few of them. I'd do some searching and locate one that suits your situation the excellent. I would stick with one who figures in escrow associated with insurance and taxes included in so you true cost of a home. I'd also try to get pre-approved to borrow money at a banker nevertheless i wouldn't the particular maximum amount they say you can borrow because you finances will be very tight.